Fed Lack Of Confidence Sends WTI Crude To $33 Handle Even As Dollar Dumps

The FOMC Minutes hardly rang loudly and proudly of the strong economy that warrants rate hikes... and crude is tumbling.

The FOMC Minutes hardly rang loudly and proudly of the strong economy that warrants rate hikes... and crude is tumbling.

Last month, in what will likely be viewed in hindsight as an ill-fated attempt to begin the long and painful process of normalizing monetary policy, the Fed "went there." Janet Yellen raised rates.

Investors were meant to take solace in the FOMC's use of the term "gradual" to describe the trajectory for rates going forward, as well as from the apparent unanimity, but as is becoming more clear with each passing week, "liftoff" was a policy mistake and may well go down as the worst timed rate hike in history.

Since The December 16th FOMC decision to hike rates, Gold is up over 2%, Bonds up 1%, and stocks down 3% suggesting the word "error" with regard Fed policy. As The FOMC Minutes are released, traders anticipate confident-hawkishness and a focus on ignoring current data in favor of preferring their own confident outlook:

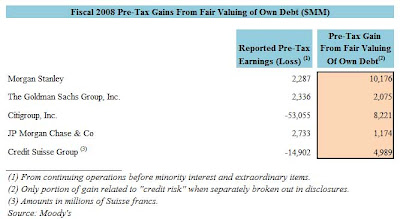

Nearly 7 years ago, shortly after Mark-to-Market was indefinitely suspended, and Mark-to-Unicorn as we first dubbed it was revealed, we described an odd accounting peculiarity which in the coming years would take the financial world by storm: the so-called "Fair Value Option", and its practical offshoot, the Credit/Debt Value Adjustment (CVA or DVA).

Here was our quick and dirty explanation from April 2009:

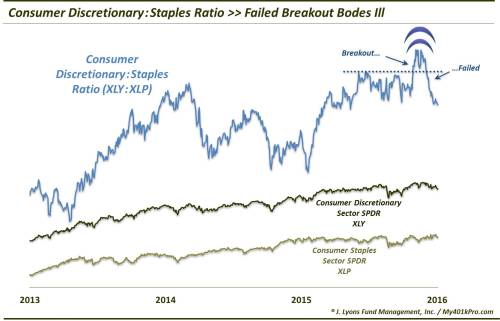

Via Dana Lyons' Tumblr,

The relative strength of the consumer discretionary sector versus consumer staples had been a positive for stocks – not anymore.