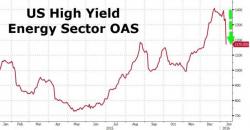

Here's The Real Reason High Yield Energy Credit Risk Collapsed This Morning

A few market participants have noticed that the US High Yield Energy sector's credit risk collapsed 170bps this morning according to Bloomberg's data. This is the biggest plunge (rally) in the index of "incredibly risky stuff" on record and in the face of new cycle lows in crude, borrowing bases contracting, and rig counts crashing, this seemed odd... well here is why the index collapsed (spoiler alert - do not get excited).

So this happened and everyone rejoiced...

But here is why...