Arthur Berman: Why The Price Of Oil Must Rise

Submitted by Adam Taggart via PeakProsperity.com,

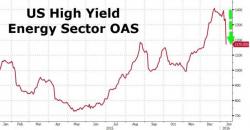

Geologist Arthur Berman explains why today's low oil prices are not here to stay, something investors and consumers alike should be very aware of. The crazy-low prices we're currently experiencing are due to an oversupply created by geopolitics and (historic) easy credit, not by sustainable economics.