China Is The New Japan After All: Here's How To Trade It

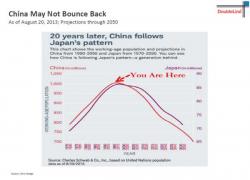

In an odd coincidence, just as we were preparing an article showing how China is becoming increasingly more like Japan and hot to trade this convergence, we happened to glance at the slide that Jeff Gundlach was talking about at that exact same moment during his afternoon presentation, and lo and behold, the "new bond king" was discussing why, among the reasons why "China may not bounce back", is that China is increasingly becoming a Japanese demographic doppelganger...

... in a slide that was sourced from, of all places, Zero Hedge.