MacroStrategy Explains Why Most Stocks Have Already "Crossed The Rubicon"

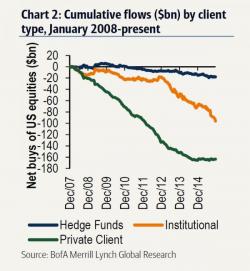

As we have reported on numerous prior occasions, the biggest marginal buyer of stocks in both 2014 and 2015 (and forecast to remain in 2016), are corporations themselves, using debt-funded buybacks to push their stocks to record highs, allowing the smart money to sell in record amounts.

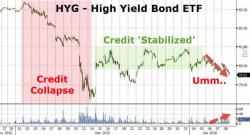

But what happens when companies are so levered that they can't possibly afford to issue any more debt, virtually all of which has been used to repurchase stocks, as we have shown before...