Puerto Rico Is Greece, & These 5 States Are Next To Go

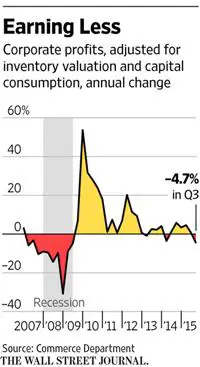

As Wilbur Ross so eloquently noted, for Puerto Rico "it's the end of the beginning... and the beginning of the end," as he explained "Puerto Rico is the US version of Greece." However, as JPMorgan explains, for some states the pain is really just beginning as Municipal bond risk will only become more important over time, as assets of some severely underfunded plans are gradually depleted.

Wilbur Ross discusses Puerto Rico's debt struggles and where it goes from here...

http://www.bloomberg.com/api/embed/iframe