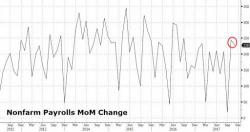

Where The Jobs Were In November: Who's Hiring... Who Isn't

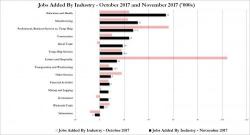

Assuming that the BLS' estimate of avg hourly warnings growing only 0.2% in November is accurate, it would imply that - as has often been the case - the bulk of job growth in November took place in minimum-paying and other low-wage jobs. However, a breakdown of jobs added by industry shows the contrary to expectations, the bulk of new job creation, and 3 of the 4 top category, were not in the "low wage" bucket.