Tech Stocks Jump But Banks, Bond Yields, & Black Gold Dump

Tech stocks bounced today (perhaps on AMT chatter) sparking a chorus of confirmation-bias-based commentary that the bull is back... but we suspect that parrot is still dead...

Tech stocks bounced today (perhaps on AMT chatter) sparking a chorus of confirmation-bias-based commentary that the bull is back... but we suspect that parrot is still dead...

Authored by Kevin Muir via The Macro Tourist blog,

Last week there were all sorts of articles hitting the newswires about the fact the world’s stock market total capitalization was pushing $100 trillion.

This article and chart from Business Insider sums up the reaction:

For the first time in history, the price of Bitcoin has surpassed $13,000 (rising from $12,000 in less than a day).

For those keeping track, this is how long it has taken the cryptocurrency to cross the key psychological levels:

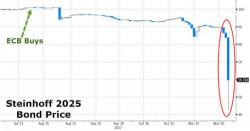

While you were sleeping, the stock and bonds of a relatively unknown company in the US, but is a household name in much of the rest of the world, Steinhoff International Holdings NV, plunged after its chief executive officer resigned amid accounting irregularities, with the company announcing that it was indefinitely delaying the release of its results, citing a criminal and tax investigation in Germany that dates back to 2015, rocking a company that’s rapidly expanded from its roots in South Africa into a retail empire spanning Australia, Europe and the U.S.

Tech is warning about inflation.

Tech performs terribly during periods of higher inflation. If you think I’m making this up, take a look at the NASDAQ’s performance versus Gold during the last inflationary spike in 2011.

Tech tanked, Gold soared.

Which is why the recent very bearish breakdown in Tech is worth noting.

Between this and the rise in inflationary signals in the financial system (the NY Fed's UIG, the Cleveland Fed's stick inflation, and Producer Price Indexes), it’s looking more and more like 2018 will be a repeat of 2011.