Market Goes 'Full Bitcoin'

Authored by Lance Roberts via RealInvestmentAdvice.com,

Market Review

What the “heck” was that?

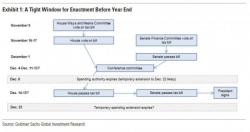

This past week seemed to be the story of Christmas coming early. Earlier this week the markets surged higher on hopes that “Ole’ St. Tax Cuts” would soon be here. But that dream seemed to be short-lived on Friday, at least at the open, as General Mike Flynn seems to embody the “Grinch” trying to steal Christmas.