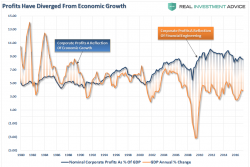

The Mean-Reverting History Of Profit Growth

Authored by Lance Roberts via RealInvestmentAdvice.com,

As the markets push once again into record territory the question of valuations becomes ever more important. While valuations are a poor timing tool in the short term for investors, in the long run, valuation levels have everything to do with future returns.

Yesterday, Doug Kass penned an interesting note on the current market advance: