Stocks Sink But Bitcoin Bursts To Record Highs On Cyber Monday

Whatever you do - remember "all is well"

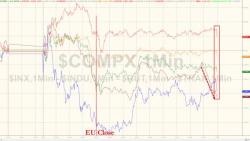

Dow ended higher (with MMM and HD the biggest drivers) as Trannies, Small Caps (ugly into the close), and the Nasdaq red with S&P clinging to unchanged...until the very last minute...