DB's "2018 Credit Outlook" - Killer Charts Point To Bearish Not Benign Conclusion

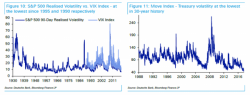

DB’s Jim Reid has released his “2018 Credit Outlook”. In our first pass on this 60-pager earlier, we noted that Reid characterised 2017 as the most “boring year ever”, since it will go down as one of, if not the least, volatile year for the majority of asset classes.