$1 Trillion Norway Wealth Fund Sees "Red Flag" In Real Estate Market

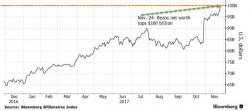

Back in September, we pointed out that assets managed by Norway's sovereign wealth fund had surged to over $1 trillion after they made the controversial decision to increase their exposure to global equity bubbles (see: Norway Wealth Fund Assets Surge To Over $1 Trillion On Massive 70% Allocation To Equities). The move has worked out perfectly in the short term, though we still have our doubts as to whether the "greater fool" theory works over the long term...certainly it never has before but maybe this time is different.