World Largest Reseller Of Virtual 'Skins' Raises $40M With An ICO

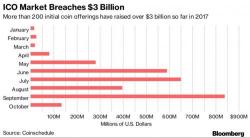

ICO Investors are about to experience something that’s almost never happened in the brief history of the $3 billion market: An offering by a company with an actual product.

ICO Investors are about to experience something that’s almost never happened in the brief history of the $3 billion market: An offering by a company with an actual product.

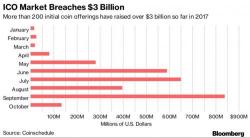

As online retailers in the United States prepare for Cyber Monday, i.e. the biggest online shopping day of the year, China’s largest e-commerce company just recorded the biggest day in its history.

As Statista's Felix Richter notes, on November 11, Chinese Singles’ Day, online shoppers bought merchandise worth more than $25 billion across Alibaba’s platforms (mainly Tmall and Taobao), shattering last year’s sales record in the process.

Authored by David Stockman via The Daily Reckoning,

103 years ago, in 1914, the Federal Reserve opened-up for business as the carnage in northern France was getting under way.

And it brought to a close the prior magnificent half-century era of liberal internationalism and honest gold-backed money.

The Great War was nothing short of a calamity, especially for the 20 million combatants and civilians who perished for no reason discernible in any fair reading of history, or even unfair one.

Almost exactly one year ago, the IRS realized that it could be leaving billions of dollars on the table in the form of uncollected taxes, and launched a tax-evasion probe on the largest US Bitcoin exchange, Coinbase, seeking to identify all Coinbase users in the U.S. who “conducted transactions in a convertible virtual currency” from 2013 to 2015.

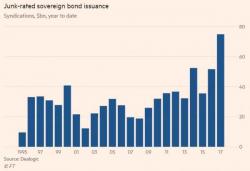

It seems that the never-ending "thirst for yield" from the world's massive pension funds, combined with the ever-present "cash on the sidelines" problem, is driving the creation of yet another global financial bubble in emerging market junk bonds. Alas, as the FT points out today, the world's largest fixed income investors can't seem to get enough of the risky paper as bond issuance by the most financially vulnerable countries has suddenly spiked to a all-time high of $75 billion just as spreads are tightening to all-time lows.