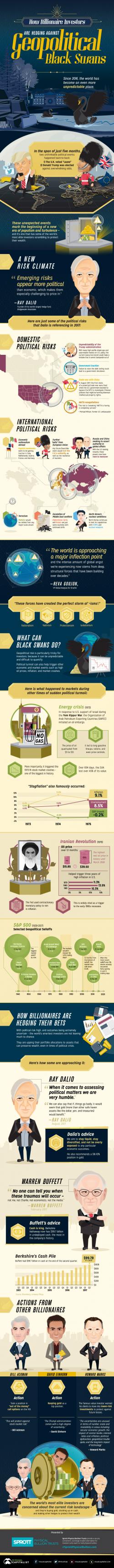

Visualizing How Billionaire Investors Hedge Against Geopolitical Black Swans

Investors must always be comfortable with the idea that the market bears risk.

Sometimes this risk flies under the radar and isn’t as pronounced as it probably should be. However, as Visual Capitalists's Jeff Desjardins notes, in other cases, the topic of risk can catapult to the forefront of discussion. There can be specific events or signals unfolding that give investors the jitters – and during these times, investors will make adjustments to their portfolios to avoid getting caught off guard.

HOW BILLIONAIRES ARE HEDGING