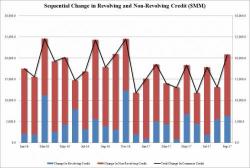

US Credit Card Debt Rises Above $1 Trillion As Student, Auto Loans Hit All Time High

Earlier in 2017, using the latest Fed data newspapers and financial media reported that US consumer credit card debt had risen above $1 trillion for the first time since the financial crisis.