Is Korea Just A Smokescreen?

Authored by Bryan McBride via Mises Canada,

Is Korea just a smokescreen?

Authored by Bryan McBride via Mises Canada,

Is Korea just a smokescreen?

Authored by Adam Taggart via PeakProsperity.com,

Dr. Ron Paul has long been a leading voice for limited constitutional government, low taxes, free markets, sound money, civil liberty, and non-interventionist foreign policies.

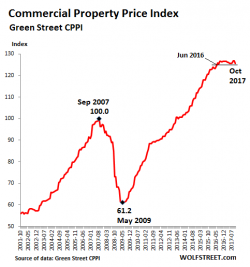

By Wolf Richter, WOLFSTREET.com:

Commercial real estate prices soared relentlessly for years after the Financial Crisis, to such a degree that the Fed has been publicly fretting about them. Why? Because US financial institutions hold nearly $4 trillion of commercial real estate loans. But the boom in most CRE sectors is over.

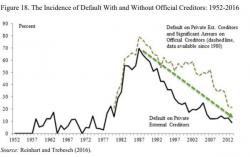

Authored by Carmen Reinhart via Project Syndicate,

Usually, a sudden stop in capital inflows sparks a currency crash, sometimes a banking crisis, and quite often a sovereign default. Why, then, has the worldwide incidence of sovereign defaults in emerging markets risen only modestly?

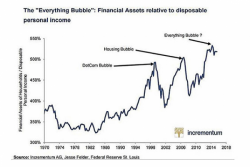

Two weeks ago, we discussed the recent report from Artemis Capital Management, “Volatility and the Alchemy of Risk – Reflexivity in the Shadows of Black Monday 1987”, authored by Christopher Cole. See “In the Shadows Of Black Monday – “Volatility Isn’t Broken…The Market Is”. The full report can be accessed here.