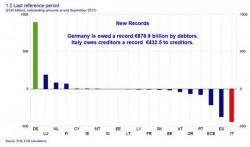

Italy Target2 Imbalance Hits Record €432.5 Billion As Dwindling Trust In Banks Plunges

Authored by Mike Shedlock via www.themaven.net/mishtalk,

Contrary to ECB propaganda, Target2 imbalances are a direct result an unsustainable balance of payment system. The imbalances represent both capital flight and debts that can never be paid back. If you think Italy can pay German and other creditors a record €432.5 Billion, you are in Fantasyland.

The interesting aspect of Italy's new record Target2 Imbalance is that it comes just as Dwindling Trust in Italian Banks is on the rise.