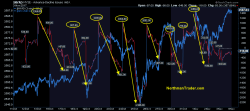

PBOC's Zhou Warns Of "Sudden, Complex, Hidden, Contagious, Hazardous" Risks In Global Markets

Just two weeks after warning of the potential for an imminent 'Minsky Moment', Chinese central bank governor Zhou Xiaochuan has penned a lengthy article on The PBOC's website that warns ominously of latent risks accumulating, including some that are "hidden, complex, sudden, contagious and hazardous," even as the overall health of the financial system appears good.

The imminence of China's Minksy Moment is something we have discussed numerous times this year.