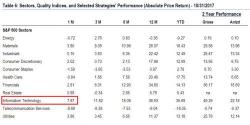

Tech Stocks Accounted For 75% Of The Market's October Return

For some context on the unprecedented dominance of the tech sector on the overall market, here is some perspective from BofA's Savita Subramanian on October returns, when Tech continued to lead the other ten sectors, generating +7.8% on a total return basis. This translates into a whopping 75% of the S&P 500's return last month!