Goldman's Clients Are Becoming Increasingly Schizophrenic

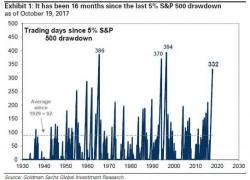

Last weekend, Goldman's clients were nervous: after 16 months without a 5% pullback in stocks, they were afraid that a steep correction could take place at any moment.

Last weekend, Goldman's clients were nervous: after 16 months without a 5% pullback in stocks, they were afraid that a steep correction could take place at any moment.

If 'growth' was the goal of the tax-reform plan, the bond market ain't buying it...

The yield curve continues to slump...

Breaking down to new cycle lows - flattest since 2007...

On Thursday afternoon, around 3pm, Donald Trump will officially nominate Jerome Powell to be the next Chair of the Federal Reserve, replacing Janet Yellen when her term is up on February 1st. According to virtually every financial analyst, the former Carlyle Partner, Jay Powell, represents "continuity" on the Federal Reserve and would conduct monetary policy in a similar fashion as Yellen. As a result, Powell will proceed with the current balance sheet normalization schedule and continue to guide markets toward the "dots".

Sometimes you just have to laugh...

VIX was samshed to 9 handle to eensure that the market signals its approval of the Trump Tax plan...

Everything recovering from the initial reaction...

Authored by Thorsten Polleit via Mises Canada,