The Intrigue At The Heart Of The Beijing-Riyadh-Washington Triangle

Authored by Valentin Katasonov via The Strategic Culture Foundation,

Authored by Valentin Katasonov via The Strategic Culture Foundation,

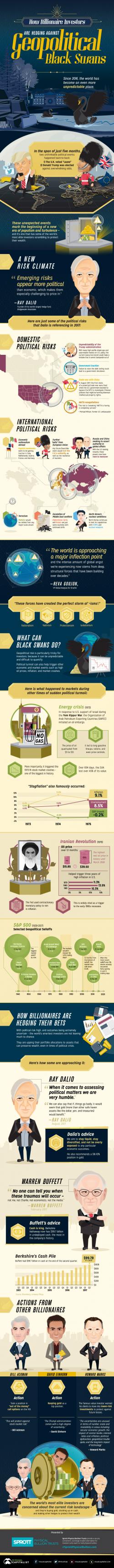

Investors must always be comfortable with the idea that the market bears risk.

Sometimes this risk flies under the radar and isn’t as pronounced as it probably should be. However, as Visual Capitalists's Jeff Desjardins notes, in other cases, the topic of risk can catapult to the forefront of discussion. There can be specific events or signals unfolding that give investors the jitters – and during these times, investors will make adjustments to their portfolios to avoid getting caught off guard.

HOW BILLIONAIRES ARE HEDGING

We know... there are several candidates to choose from. For example…

It might be Anbang - the acquisitive insurance behemoth – see “Anbang Just Became A ‘Systemic Risk’: Revenues Crash As Its Chairman Is “Detained”

It might be China Evergrande – the developer of “ghost” properties and described by J Capital’s, Anne Stevenson-Yang as “the biggest pyramid scheme the world has yet seen” – see “Stevenson-Yang Warns ‘China Is About To Hit A Wall”.

Here we go again, the third trial, following two appeals, in which former JP Morgan Wealth Manager, Jessica Sharkey, claims she was unfairly dismissed after whistleblowing on one of the bank’s clients shortly after the Bernie Madoff scandal came to light.

http://www.scribd.com/embeds/363297018/content

The client in question, an Israeli with involvement in the diamond cutting and pre-paid calling card businesses, was a “big fish”, was generating about $600,000 of revenue annually for the bank.

Submitted by RanSquawk

The BLS will release the October Employment Report at 08:30am ET on Friday, November 3. The Street is looking for a veritable surge in hiring following the hurricane-related disruption last month sent monthly payrolls to the first negative print in 7 years. Analysts also expect wage growth to continue rising: Median forecasts looks for 310k nonfarm payroll jobs, with average hourly earnings rising rise to 2.7% Y/Y

Key forecasts: