Previewing Wednesday's Fed Policy Decision: The Week's Biggest Non-Event

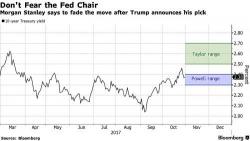

While normally Wednesday's Fed meeting would be the week's biggest market-moving event, this time - smack in the middle of the busiest earnings week of the year - it may not even make the top three, buried ahead of the coming news of the next Fed Chair (in which Trump is set to unveil Jerome Powell on Thursday), and the GOP tax bill (which just saw its Wednesday release delayed by one day).