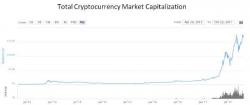

Are Cryptocurrencies Inflationary?

Authored by John Rubino via DollarCollapse.com,

There’s a debate raging over what, exactly, bitcoin and the thousand or so other cryptocurrencies actually are. Some heavy-hitters are weighing in with strong, if not always coherent opinions:

Jamie Dimon calls bitcoin a ‘fraud’JPMorgan Chase CEO Jamie Dimon did not mince words when asked about the popularity of virtual currency bitcoin.