As Lithium Booms, Some Analysts Sound Note Of Caution

In “Mad Scramble for Lithium Mines From Congo to Cornwall”, Bloomberg puts some colour on current conditions in the red hot sub-sector.

In “Mad Scramble for Lithium Mines From Congo to Cornwall”, Bloomberg puts some colour on current conditions in the red hot sub-sector.

Via Golem XIV's blog,

Will the rise of China mean the fall of America? In a word, yes. Although decline might be more accurate.

Why do I think this? Because China is about to launch the PetroYuan and when it does the demand for dollars and for dollar denominated debt will shrink. When it does, I question whether the world will be so sanguine about the level of debt that America carries. If that happens then the value of the dollar is in question.

As technology stocks and securitized mortgages have demonstrated all too recently, just because a bubble pops doesn’t mean it’s the end of the market. Hell, it doesn’t even necessarily preclude that another bubble won’t emerge years later.

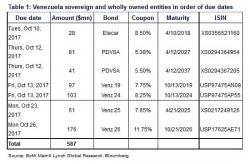

This past weekend, Venezuela failed to make $237 million in bond coupon payment, blaming "technical glitches" when in reality it simply did not have the money (or wish to part with it). Adding the $349 million in unpaid bond interest accumulated over the past month as of last Friday, that brings Caracas' unpaid bills to $586 million this month, just days before the nation must make a critical principal payment.

Share prices of Indian state banks surged as the government announced it would hand over $32bn to recapitalize the sector. According to Reuters, the motivation was a bid by Prime Minister Narendra Modi to tackle a major drag on the economy that has frustrated his attempts to boost growth.