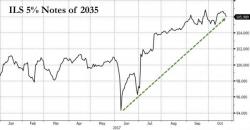

Muni Investors Celebrate "Juicy" 3.74% Yield On New Illinois Bonds As State Hurdles Toward Bankruptcy

Muni investors seem to be absolutely elated today by the opportunity to scoop up their fair share of $4.5 billion worth of new Illinois bonds due in 2028 at a "juicy" yield of 3.74%...which makes a ton of sense if you can look beyond the fact that the state looks to be on an inevitable collision course with bankruptcy.

Be that as it may, Wells Fargo Portfolio Manager Garbriel Diederich insists that the new issue "offers a tremendous amount of yield in a pretty yield-starved environment." Per Bloomberg: