A 52-"Weak" High For Stocks?

Via Dana Lyons' Tumblr,

While the S&P 500 his on an impressive string of new highs, a number of them have come on questionable breadth.

Via Dana Lyons' Tumblr,

While the S&P 500 his on an impressive string of new highs, a number of them have come on questionable breadth.

Earlier this week we sent this message to Premium and Sector Members and I wanted to share it with our viewership today.

Below looks at the Bank Index (BKX) over the past 20-years and why the Power of the Pattern feels this could become a very important price point for the bulls.

CLICK ON CHART TO ENLARGE

For the past several months, cities all across the country have been competing for the opportunity to host Amazon's second headquarters which promises $5 billion in capital investment and 50,000 new jobs over a period of time. And now that the bids are in, we have the opportunity to review some of the staggering tax subsidies offered to one of Silicon Valley's biggest companies.

It seems that it was just yesterday when the market was celebrating Trump's avoidance of a government shutdown due to an "unprecedented" bipartisan deal with Democrats, which left Republicans out in the cold. Well, things are once again back to normal.

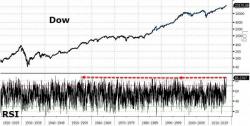

Has the market's "melt-up" levitation finally ended? Of course, it could be much worse: as Bloomberg's Paul Jarvis recalls, thirty years ago on this day traders around the globe were staring at their screens in disbelief as stock markets turned to a sea of red: the Dow, S&P 500, FTSE, DAX and CAC fell -23%, -20%, -10%, -9% and -10% respectively.