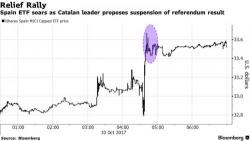

Spanish Government Begins Process To Suspend Catalan Autonomy

In a much anticipated televized briefing, Spanish Prime Minister Mariano Rajoy formally demanded the Catalan leader clarify whether independence has been declared, saying that is needed before he can decide what steps to take. The Spanish leader announced that the central government has moved to take the first step towards suspending home rule in Catalonia on Wednesday morning.

"Cabinet has agreed to notify the Catalan government [so that it may] confirm if it has declared independence", he said.