Bank of America: "This Is The Most Consensus Trade In The World"

One week ago, BofA chief investment strategist Michael Hartnett laid out his reasoning for why a market correction is imminent:

One week ago, BofA chief investment strategist Michael Hartnett laid out his reasoning for why a market correction is imminent:

JP Morgan (JPM)

Having notched an all-time high by closing at 97.35 on 10/3, JPM appeared to be consolidating over the next 6 sessions - in preparation for another surge higher. But 10/12’s Q3 earnings release session suggests that immediate bullish momentum may have been exhausted and, with it, Sir Jamie’s next (ever-so-lovable and antithetically Populist) all-time high “I’m richer than you” quip has been - akin to PM Jordan's Bitcoin prop traders - placed in limbic limbo.

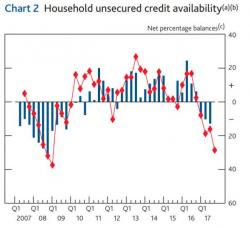

As if Theresa May did not face enough challenges, the latest survey from The Bank of England (BoE) suggests the British consumer is about to face the biggest credit crunch since the great financial crisis.

After repeated warnings from BoE about the surging pace of lending to households, British lenders are planning the biggest cutback in consumer loans in nearly 10 years (BoE's quarterly net balance of lenders' expectations for the availability of unsecured lending over the next three months fell to -28.6 from -16.2.)

Authored by Raul Ilargi Meijer via The Automatic Earth blog,

For those of you who don’t know Andy Xie, he’s an MIT-educated former IMF economist and was once Morgan Stanley’s chief Asia-Pacific economist. Xie is known for a bearish view of China, and not Beijing’s favorite person. He’s now an ‘independent’ economist based in Shanghai. He gained respect for multiple bubble predictions, including the 1997 Asian crisis and the 2008 US subprime crisis.

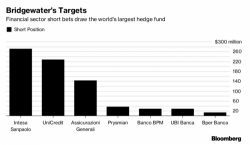

While in recent days Bridgewater has been in the news not for its investing acumen (or lack thereof), or the outspoken, contrarian views of its founder Ray Dalio, but rather the recent spirited attack by Jim Grant who in not so many words hinted, if not explicitly stated, that there is something very rotten in the state of (Westport) Connecticut (a theatrically sponsored defense was inevitable), it is still the case that any major investing move the hedge fund...