JPMorgan, Citi Just Boosted Their Loan Loss Reserves By The Most In 4 Years

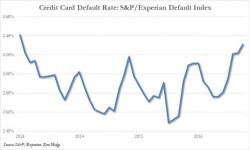

Four months ago, when looking at the latest S&P/Bankcard data, we first reported that credit card defaults had surged the most since June 2013, a troubling development which ran fully counter to the narrative that the economy was recovering and the US consumer's balance sheet was improving.