Bitcoin Rips, Banks Dip As Fed Crushes Yield Curve To 10-Year Flats

The yield curve collapse means nothing...

Don't sweat it...

The yield curve collapse means nothing...

Don't sweat it...

Many years ago, when it was still unclear who would replace then outgoing Fed chair Ben Bernanke, Zero Hedge endorsed John Taylor for the role of Fed chair: a futile endorsement as it had no chance of ever coming true due to Taylor's famous and long-running feud with the Fed over what the true Fed Funds rate should be, and the various pro forma adjustments the Fed imposed upon Taylor's own "Taylor Rule."

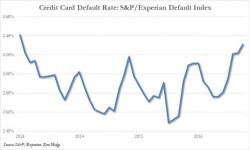

Four months ago, when looking at the latest S&P/Bankcard data, we first reported that credit card defaults had surged the most since June 2013, a troubling development which ran fully counter to the narrative that the economy was recovering and the US consumer's balance sheet was improving.

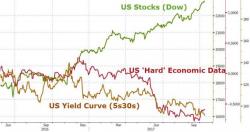

The persistent flattening of the Treasury yield curve appears to still have legs, and that may be a sign of economic trouble ahead.

As Bloomberg details, on Wednesday, the minutes of the Federal Reserve’s September meeting revealed policy makers’ resolve to stick to their tightening path.

The yield curve's reaction to that un-data-dependent hawkishness is very evident... (worsened by today's strong 30Y auction)

Authored by Andrew Zatlin via MoneyballEconomics.com,

Total Retail Spend Grows On Hurricane-Linked Demand

First, I want to point out that the two hurricanes that have devastated Texas, Florida, and Puerto Rico have been horrible.

Hundreds of thousands, if not millions of peoples’ lives were affected. And their circumstances have changed dramatically over these past couple months.

BUT… these hurricanes were a positive for economists looking for a boost in spending.