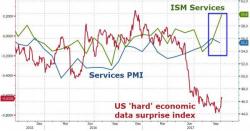

ISM Services Spikes To 12-Year Highs - Beats Expectations By 5 Standard Deviations (As PMI Slides)

After the schizophrenic manufacturing data (ISM 13yr highs, PMI unch YoY), Services data was just as fucking ridiculous!

UK and EU Services PMIs rose (and beat expectations) but US' September PMI dropped from 56.0 to 55.3.

Markit's Services PMI dropped to 55.3 (dragging the composite index lower) as inflationary pressures intensify (highest in 3 years), and future optimism is at its lowest since February.