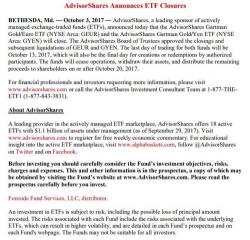

Two Gartman ETFs To Close

Even in a time when retail investors are (almost) literally throwing money at ETFs, and the passive industry is growing by billions of dollars each day at the expense of active managed funds, there are occasional casualties, and on Tuesday afternoon it was Dennis Gartman's turn. According to AdvisorShares, which offers 18 ETFs with $1.1 billion of assets under management, the ETF administrator has begun the process of closing two Gartman ETF products, the Gartman Gold/Euro ETF (NYSE Arca: GEUR) and the AdvisorShares Gartman Gold/Yen ETF (NYSE Arca: GYEN).