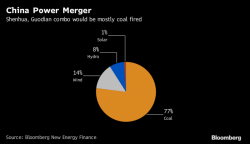

One Chinese Coal Power Company Employs 4x More Workers Than The Entire US Coal Industry

On Monday, China’s government and president Xi blessed the merger between the country's top coal miner, Shenhua Group and China Guodian Group, one of the country’s top five state power producers, in a deal that will create the world’s largest power company, worth 1.8 trillion yuan, or $278 billion. Putting the sheer size of the two merged behemoths in context, the resulting entity will be the world’s second-biggest company by revenue and largest by installed capacity.