Matt King: Global QE And "ETFs Everywhere" Have Created An Unstable, One-Way Market

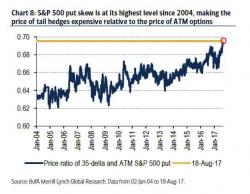

While the financial industry remains divided over what precisely is the cause of the malaise that affects modern markets, characterized by plunging volumes and trading activity, record low volatility and dispersion, a relentless ascent disconnected from fundamentals, and generally a sense of foreboding doom, manifested by an all time high OMT skew - or record high price for crash insurance - as discussed previously...