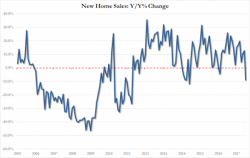

"Winter Is Here" For Housing - Whalen Warns "The Crowd Of Buyers Is Thinning"

Following this morning's plunge in new home sales...

After household formation collapsed in June...

It appears Institutional Risk Analyst's Chris Whalen is spot on with his mortgage finance update: "Winter Is Here"...