The Real Story Behind Goldman's Q2 Trading Loss: How A $100M Gas Bet Went Awry

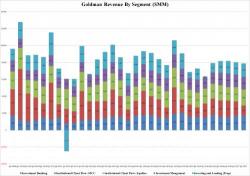

Goldman Sachs FICC-trading income was an unexpectedly ugly blemish on what was already a poor Q2 earnings report. And while the FDIC-backed hedge fund initially blamed the decline on lower trading revenues, lack of volatility and depressed client activity...

... there was more to the story. The Wall Street Journal has uncovered what really happened: A $100 million bet on regional natural-gas prices gone awry after production problems at a local pipeline sent prices soaring, decimating Goldman’s short position.