Shocking Admission From Global Head Of Strategy: "Our Clients Have Given Up On Valuation As A Metric"

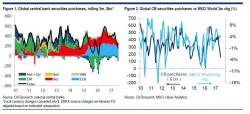

For all the recent concerns about an "imminent" nuclear war with North Korea (not happening, according to the head of the CIA), which prompted a stunned reaction from Morgan Stanley which earlier today observed the "70% rise in the VIX index over three days, 2% drop in global equities, and more than a few holidays disrupted", leading it to conclude "Well, That Escalated Quickly", the market continues to ignore the real risk: the upcoming central bank balance sheet taper which will have a dire and drastic impact on markets according to Citi's global head of credit product strategy, Matt King