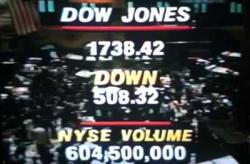

What Happens When $500 Billion in Risk Parity Funds Hit "Sell" on Stocks?

The market riggers are now pulling the pin.

All market rigs end badly. And given the fact that this one has been particularly egregious, the results will be quite ugly.

You cannot pin the S&P 500, perhaps the single most important stock index in the world, for weeks and expect it to end well. This is particularly true when you’re pinning it using Risk Parity Funds and their “buy/sell” algorithms.

Those same algorithms that have mindlessly bought stocks every time the VIX gets smashed, will mindlessly SELL stocks when the VIX explodes higher.