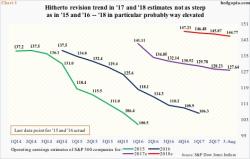

Elevated 2018 Estimates Widen Gap Between GAAP & Non-GAAP Earnings

Via Hedgopia.com,

As of last Thursday, a little over four-fifths of S&P 500 companies reported 2Q17 results. Of the 422 companies, 70.1 percent beat on operating earnings, 20.6 percent missed and 9.2 percent met, as per S&P Dow Jones Indices.