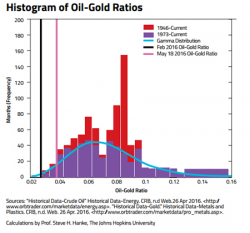

Is the “Oil God” Andy Hall Dead?

Authored by Steve H. Hanke of the Johns Hopkins University. Follow him on Twitter @Steve_Hanke.

Andy Hall, the “Oil God,” acquired that attribution after making flawless, bullish calls on oil and loads of cash for his clients at Astenbeck Capital Management. Of late, the markets have failed to cooperate with Hall. So, he has renounced his bullish faith. Indeed, the Oil God has thrown in the towel on what had been his perma-bullish position on oil.