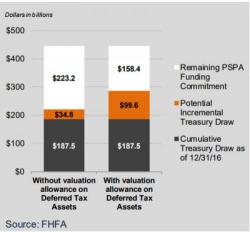

Fannie, Freddie Would Need $100BN Bailout In New Financial Crisis

While the latest Fed stress test found that all US commercial banks have enough capital to survive even an "adverse" stress scenario, a severe recession in which the VIX hypothetically soars to 70, the two US mortgage giants would not be quite so lucky: according to the results from the annual stress test of Fannie Mae and Freddie Mac released today by their regulator, the Federal Housing Finance Agency, the "GSEs" which were nationalized a decade ago in the early days of the crisis, would need as much as $100 billion in bailout funding in the form of a potential incremental Treasu