Despite Earnings Season Beats, Analyst Expectations Have Barely Budged

Authored by Bryce Coward via Knowledge Leaders Capital blog,

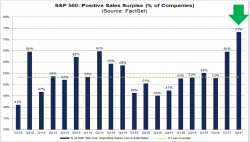

By most accounts the Q2 earnings reporting season has been a good one, with most companies surprising to the upside and some offering improved guidance for future numbers.

In fact, according to FactSet, more companies have posted a positive sales surprise in Q2 than any quarter going back at least five years (chart 1).