Analyst Warns of Debt Bomb, Credit Expansion, and Wanton Chicanery in China

Content originally published at iBankCoin.com

Do not worry about anything you're about to read. In fact, close out your browsers now and go to sleep -- since it's late and you must be really sleepy.

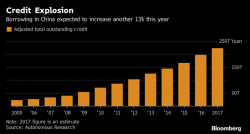

Charlene Chu from Autonomous Research is out with a note warning about Chinese credit expansion. Before we delve into the details, let's have a gander at said 'credit expansion.'

Wanton amount of credit cards