Apple Surges To New Record High On Strong iPhone 8 Guidance, Earnings Beat Despite iPhone Sales Miss

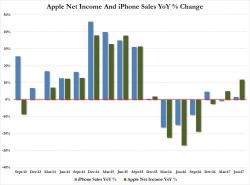

With Apple trading just shy of all time highs (and with a quarter trillion in cash on the books), the market was wondering if AAPL can once again surprise to the upside ahead of the all important iPhone 8 quarter, as well as provide some guidance what it plans to do with its cash hoard. And while, there was no explicit guidance on the now $260BN+ in gross cash, Apple has surged after hours on the strong top and bottom line beat, and just as strong guidance, despite a small iPhone sales miss in the current quarter.