It's Your Money But You Can’t Have It: EU Proposes Account Freezes To Halt Bank Runs

Authored by Mike Shedlock via MishTalk.com,

If there is a run on the bank, any bank in the EU, you better be among the first to get your money out.

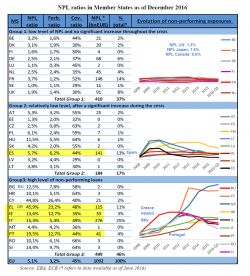

Although it’s your money, the EU wants to Freeze Accounts to Prevent Runs at Failing Banks.

European Union states are considering measures which would allow them to temporarily stop people withdrawing money from their accounts to prevent bank runs, an EU document reviewed by Reuters revealed.