One Trader Warns Of An "Explosion Of Large Block Trades Across Rates Markets"

While The FOMC statement yesterday had a little for everyone (dovish inflationary comments and hawkish employment and balance sheet normalization), the bottom line is that, as former fund manager Richard Breslow notes, Yellen has kicked the can down the road one more time to avoid making any decision before the start of autumn: "they are only human and well aware of the fact that August has repeatedly been a cruel month for upsetting their best-laid plans for September."

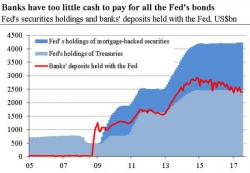

Via Bloomberg,