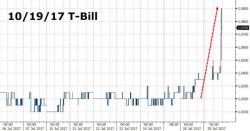

T-Bill Tantrum: Yields Spike As Debt-Ceiling Anxiety Begins To Show

US default risk has flatllined for weeks, market risk has leaked to record lows, and Treasury Bills have 'behaved'... until now. The last two days have seen a sudden aggressive spike in the yields of T-Bills around mid-October, inverting the yirld curve as debt-ceiling anxiety starts to build quietly away from NFLX and AMZN shares.

And the yield curve has inverted as analysts start to consider the chances of a two-week government shutdown as a base-case...

For now there is no perturbation in the VIX curve for the same period.