What Bond Traders Are Most Worried About Right Now

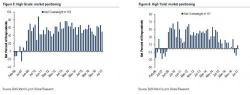

The latest monthly survey of credit investors from Bank of America, released overnight, shows the same familiar paradox we have seen ever since the start of the year: most survey respondents are allegedly scared worried about geopolitics and a concerned that the market is a bubble, and yet at the same time, most are allocating even more assets into what may be the biggest and riskiest credit bubble of them all: junk debt.