Dismal Data Sends Stocks To Record Highs As Short Interest Collapses To 2007 Lows

Overheard everywhere today...

Stocks (Dow and S&P) hit record intraday highs... (must mean everything is awesome, right?)

Overheard everywhere today...

Stocks (Dow and S&P) hit record intraday highs... (must mean everything is awesome, right?)

Since President Trump's election, global equity markets have added more absolute value than at any time in history (around $12 trillion) - surpassing the front-running exuberance that started when Bernanke hinted at QE2 in 2010.

The value of global equity markets reached a record high $76.28 trillion yesterday, up a shocking 18.6% since President Trump was elected. This is the same surge in global stocks that was seen as the market front-ran QE2 and QE3

Earlier in the week we noted the 'odd' surge in downside protection demand even as tech stocks were soaring, and now JPMorgan is noting the S&P has shifted to a large 'negative gamma' underhang which "could boost volatility if we were to sell off."

As Bloomberg notes, options markets suggest a lack of confidence in the rally. Traders are piling into downside hedges on every uptick in prices...

And JPMorgan derivatives desk writes:

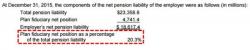

Last August, in a post that attempted to explain why public pensions are really about $8 trillion underfunded, as opposed to the $3-$5 trillion that you frequently see tossed around in the press, we described pensions in the following way:

After falling for the first time this year two weeks ago, Baker Hughes reports US oil rig count rose once again (up 2 to 765) for the 24th week in the last 25, to the highest since April 2015.

"The so-called re-balancing is likely to happen later than earlier," Michael Poulsen, an analyst at Global Risk Management Ltd, said on Friday.

It does appear we have reached an inflection point in the rig count numbers (if the historical relationship with crude holds)...